How Will American Consumers React to Moderating Inflation?

Recent data from various sources indicates that inflation is moderating or even reversing from its high levels of 2022. It also appears this downtrend is driven by major spending categories that matter the most to the personal finances of American consumers, such as rent and vehicle purchases. (The trends for things like groceries and gasoline are choppier).

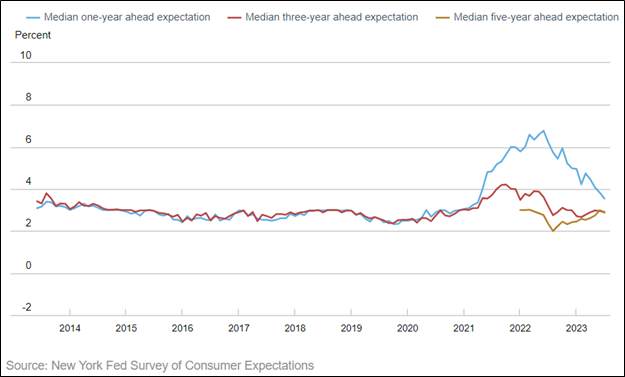

To those of us interested in the specific question of consumer response to inflation, consumer expectations of inflation are also coming down. At the aggregate level, inflation expectations surveys suggest that consumers are paying attention to the tempering of prices. In the latest results from the July 2023 Survey of Consumer Expectations conducted by the New York Fed, expectations of inflation over the next year (also called short-term horizon expectations) came down to 3.5% from 3.8% in April. (As the graphic below shows, the long-term benchmark is around 2.5%).

This is potentially good news because where consumer buying activities are concerned, perceptions often precede and drive buying behavior (A nomological chain that goes something like lowered inflation expectations -> greater optimism and financial confidence → more risk-taking -> greater spending & consumption seems reasonable).

These dual trends of lower inflation and lower inflation expectations have led many experts to heave a sigh of relief and predict that consumer buying behavior will normalize soon. In the current context, such a prediction implies a cautious optimism that the robust rate of buying and spending that we saw in consumer durables during the pandemic, consumer discretionaries afterward, and consumer staples throughout will continue or even trend higher as the 2023 holiday season approaches, and into 2024.

Such predictions beg the question of what our understanding of consumer psychology tells us about consumer reactions to moderating inflation expectations after a period of rising inflation. In this post, I want to rely on this lens and explore the question, “How is consumer behavior likely to change in response to moderating inflation?”

The question is interesting because many of us, in our roles as managers or as consumers, haven’t encountered this situation in decades, and a significant number of us (those born in the 1980s or afterward) haven’t encountered this at all.

Here’s my prediction in a nutshell, and then I will explain why in detail.

Keep reading with a 7-day free trial

Subscribe to The Pricing Conundrum to keep reading this post and get 7 days of free access to the full post archives.