B2B Pricing Case Study: Cepheid's Tuberculosis Test Pricing Dilemma

A coordinated global effort led by Médecins Sans Frontières to lower the price of a core Cepheid product creates a significant challenge. What should the company do?

Author’s Note: Thanks to Michelle Depenbrock for introducing me to Cepheid’s dilemma.

If you’re a dedicated member of the Nerdfighteria community or subscribe to its affiliated popular VlogBrothers YouTube channel, you would’ve seen an impassioned call from John Green titled “Barely Contained Rage: An Open Letter to Danaher and Cepheid” last week. The video generated over 400,000 views within a couple of days and so many calls to Danaher (Cepheid’s parent) from outraged viewers that the company had to shut down its public phone line temporarily. If you haven’t seen the video, here it is. (It’s about eight minutes long; its first five minutes cover the core issue).

The Nerdfighteria community’s involvement was part of a global effort initiated by Médecins Sans Frontières (MSF) last week to target what they, and others in the global, non-profit medical community, saw as price gouging by Cepheid for its Xpert MTB/RIF Ultra cartridge to test for tuberculosis. MSF called the campaign “Time for $5.”

The core concern raised by MSF, and amplified by influencers like John Green, was that Cepheid overcharges its captive, hapless customers, many of them governments, medical agencies, and non-profits in lower-income countries, for tuberculosis test cartridges that are essential for TB diagnosis. Cepheid’s average price per Xpert MTB/RIF Ultra test cartridge is $10, but MSF and its allies argued that cost calculations and public funding received by Cepheid for development justify a much lower $5 price as reasonable.

They pointed out that the $10 price discourages lower-income countries from adopting Cepheid’s superior GeneXpert platform to ramp up TB testing. Instead, they have to rely on an inferior but cheaper way called sputum smear microscopy, which is less accurate, ultimately leading to immeasurable suffering and an untold number of lost lives. This is MSF’s call to action:

If the intense public interest in Cepheid’s pricing stirred up by the recent viral content continues or escalates, the company’s in a serious pricing pickle. But even if it doesn’t, or if the matter is partially resolved (as is the case, more about that later), MSF’s call for action still raises some thorny questions about pricing strategy that Cepheid will have to deal with sooner or later. This issue is not going away and will resurface for its other products.

What should Cepheid do? In this post, I want to explore this pricing dilemma, along with its implications for B2B pricing decisions more generally. There are some useful lessons to be learned here.

The Facts Behind MSF’s Price Gouging Accusation

The Company. Cepheid is a twenty-five-year-old medical devices maker that sells molecular diagnostic testing machines to conduct PCR tests1 for everything from HIV, chlamydia, gonorrhea, and hepatitis to flu and Covid. It has been very successful and enjoys an excellent reputation in the molecular diagnostics industry for the quality of its products and its customer service.

In 2016, Cepheid was acquired by Danaher, a giant $32 billion conglomerate with interests in life sciences, biotechnology, molecular diagnostics, and environmental and applied solutions. Cepheid retained its brand name and product lines after being acquired by Danaher; however, as we saw in MSF’s call to action, Cepheid’s decisions (including its pricing dilemma), financial performance, and brand image have a significant impact on its parent company.

The Machine and the Diagnosis. Cepheid’s flagship product is a line of molecular diagnostic testing machines called the GeneXpert, which performs sample preparation and pathogen detection using a single cartridge-based assay. The machines range in price from $9,000 to $75,000, depending on size and testing capability.

The major advantages of the GeneXpert platform (machine plus test cartridges) are that it eliminates the need for fully equipped clinical laboratories, is simple to use, and provides rapid, accurate results within hours instead of days or weeks. These properties make it extremely effective in the field in lower and middle-income countries to test for a variety of diseases, in particular tuberculosis. Its major downside is the price, especially for single-use cartridges.

Numerous studies, such as Gotham et al. (2021) and Sasikumar et al. (2020)2, have pointed out that the PCR tests conducted by the GeneXpert platform are extremely effective for diagnosing tuberculosis in lower-income countries like Nigeria, Ethiopia, the DRC, and India. Numerous other studies, such as Williams et al. (2022) and Sorsa and Kaso (2021)3, have described that the platform’s effectiveness extends to detecting pernicious forms of TB, such as multidrug-resistant TB and extremely drug-resistant TB, increasingly found among those who are living with TB4.

Yet, TB detection rates remain frustratingly low in many African countries. For instance, as the figure below shows, Williams et al. (2022)5 reported that the case detection rate fluctuated between 15% and 30% in Nigeria during 2010-2019, without ever rising above 30%, suggesting that a vast majority of Nigerians with TB don’t get diagnosed. Once TB is diagnosed, however, treatment success rates for Nigerians are high, reaching 90% or more. South Africa and the DRC are doing better, but there’s still plenty of room for improvement. The authors attributed the low detection rates to the slow adoption of the GeneXpert platform and “inconsistent scale-up and inadequate utilisation of Xpert testing” mainly because of inadequate access to test cartridges.

The Cartridges. The test cartridges used in GeneXpert machines for the PCR tests are single-use and disposable. In conjunction with the GeneXpert machine, they deliver an accurate result within two hours.

As is typical in the medical devices industry, Cepheid has adopted the classic “consumables-first” pricing approach for the GeneXpert platform, accepting a lower margin on the machine to increase the installed base in exchange for a healthier margin and steadier positive-margin revenue on the test cartridges. The GeneXpert cartridges range in price from $10 to $25 per unit, depending on the assay, while the current preferential pricing for the Xpert MTB/RIF Ultra test cartridge is about $10.

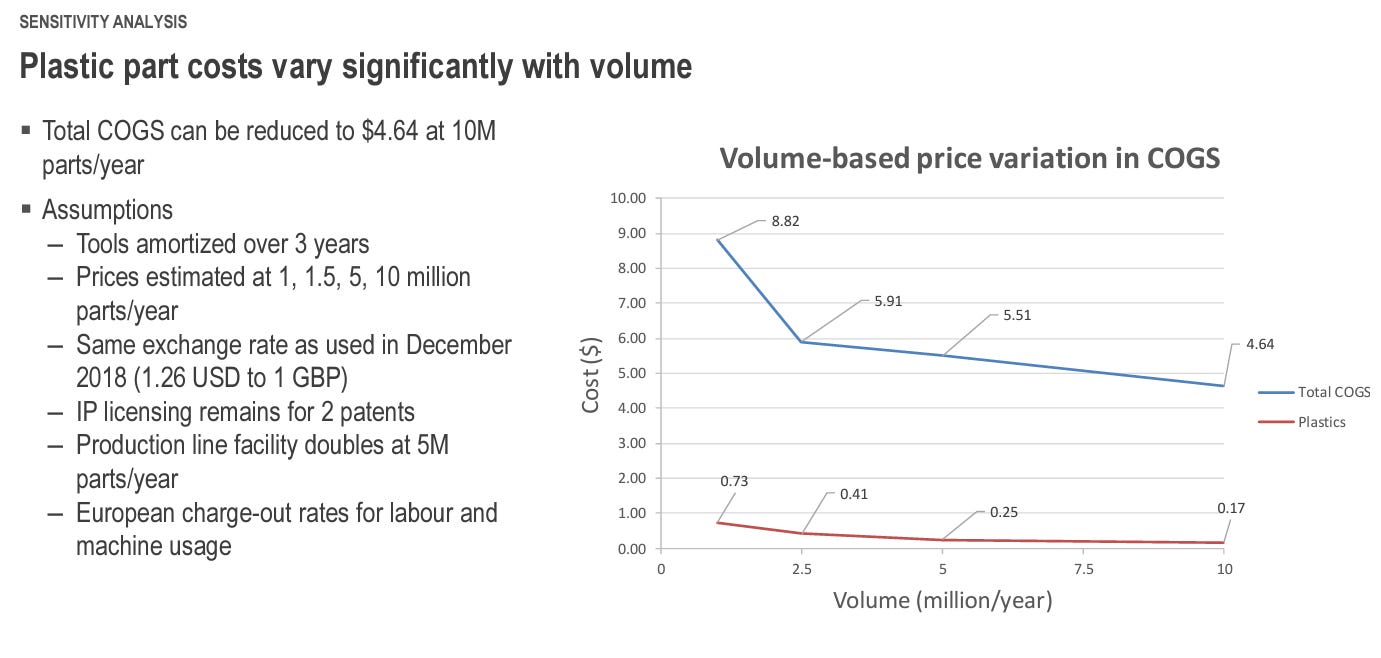

In 2019, MSF commissioned Cambridge Consultants to conduct a COGS analysis to assess how much it cost Cepheid to make the Xpert MTB/RIF Ultra test cartridge and how the cost varied with scale. The analysis, conducted in a careful and transparent way (see here for the full report), concluded that at a million units, the cost to make a cartridge was approximately $8.53.

The report also concluded that the cost declined significantly as volume increased, going down to $4.64 if Cepheid was able to sell 10 million cartridges. To provide context to this sensitivity analysis, estimates of the unserved market for TB tests are around 75 million tests per year. In other words, there is plenty of room to sell cartridges at the right (lower) price.

Public funding. One more data point is essential to fully appreciate Cepheid’s pricing dilemma. To develop the GeneXpert platform (when it was an independent company), Cepheid received substantial public funding. A study by Gotham and colleagues (2021) quantified exactly how much:

Total public investments in the development of the GeneXpert technology were estimated to be $252 million, including >$11 million in funding for work in public laboratories leading to the first commercial product, $56 million in grants from the National Institutes of Health, $73 million from other U.S. government departments, $67 million in R&D tax credits, $38 million in funding from non-profit and philanthropic organizations, and $9.6 million in small business ‘springboard’ grants.

When substantial public funding contributes to product development by a private firm, there’s a general expectation among interested parties that the company is obligated to repay, materially and through its business decisions, by looking beyond a pure profit motive to give back the money’s worth.

History and context. Although MSF’s current “Time for $5” campaign against Cepheid launched last week, this is not the first time that activists have tried to do this. Back in 2011, an organization called Treatment Action Group (TAC) ran a similar campaign with its partners by writing an open letter to Cepheid to lower prices and increase access to its TB diagnostic test. Additionally, they asked for greater transparency regarding price inputs and contracts from Cepheid in this way:

“TAC and partners call on Cepheid to provide greater transparency on the overall cost structure, including manufacturing, setup and operational costs, calibration and training requirements, royalty fees and IP holders... As more countries are investigating using the GeneXpert to improve their TB diagnostic services, the importance of an open forum for pricing discussions with key partners as well as reassessing the transparency of the original agreements becomes paramount.”

TAC, MSF, and dozens of other organizations and individuals wrote to Cepheid’s COO in 2019, reiterating the demand that “Cepheid immediately reduce the price of Xpert tests to US$ 5, inclusive of service and maintenance” because “lowering the price of GeneXpert cartridges to $5 will greatly help in closing the deadly gap in diagnosis of the world’s leading infectious killer.”

What Should Cepheid Do?

Although barely a week has passed since the initial social media outrage, Cepheid’s parent company, Danaher, has already responded decisively to defuse the situation. I will get to that in a moment. But first, Cepheid’s pricing dilemma provides us with a unique window into a host of pricing weaknesses that are common in many B2B businesses, not just Cepheid/Danaher.

I want to explore three of the weaknesses in greater detail that I feel exacerbated the problems first raised by MSF, TAC, and their allies over a decade ago and recently by the “Time for $5” campaign. They are (1) inadequate or poor communication about the logic behind prices and price changes to external constituents, (2) an inadequate consideration of price transparency, and (3) an overreliance on simplistic standard markup pricing.

Communicating the Logic Behind Prices is Essential.

B2B companies are notorious for being secretive and silent about prices. This often leads to the misbelief among external observers that they are clueless about prices. Many companies treat prices, not to mention price inputs, as a company secret and view sharing any kind of information about pricing as ceding power to customers and other constituents. This secretive mindset means B2B companies rarely provide cogent and authentic explanations about the logic behind their prices or price changes, even when this information will benefit their sales process and add positive value to their brand. And even fewer companies take the trouble to directly communicate about prices to their customers, or in this case, their product’s users (MSF, TAG, etc.) who are affected by the prices.

Natural questions that many MSF physicians and technicians working in the field may have had include “Why does this cartridge cost $10?” or “Is Cepheid ripping us off at the expense of poor TB patients?” These are the types of questions that every customer or user has about products and services they purchase, especially consequential ones. To buyers with limited budgets, every penny matters, even for life-saving products. The $10 price tag looks particularly prohibitive in comparison to the 50-cent smear-microscopy test. And when medical personnel in the field see large numbers of patients week after week that they are not able to test because they don’t have enough cartridges, their outrage at the price grows. This is understandable.

The solution is obvious but goes against the grain of many B2B corporate cultures: Communicate comprehensive and authentic information about your prices and the logic behind them to your customers and to other entities that have a stake in the buying decision. This is especially true in the healthcare industry. Many pharmaceuticals and medical devices are high-profile, life-and-death products in the sense that consumers all over the world need them to stay alive. Yet, there are vast differences in their ability to pay. This poses a core challenge to the viability of providing access to everyone who needs them. How much someone in Sierra Leone or Bangladesh can afford and how much someone in Sweden or the US can afford are dramatically different amounts. Somehow bridging this gap and serving each of these groups without alienating others is no mean task, but it must be tackled head-on, vocally and transparently. Communication about the logic behind prices is essential in doing so.

You Can’t Be Too Transparent (Especially for High-Profile, Life-Or-Death Products).

When B2B companies are reluctant to give out prices, it is no surprise that they are even more reluctant to provide any information about the inputs into their prices, such as costs and markup factors. As discussed earlier, Cambridge Consultants conducted a careful assessment of the Xpert MTB/RIF Ultra test cartridge, tearing it down to understand its architecture, the materials used, and the differences between variants, and calculating the cost of making each component, such as the different plastics, molding processes, the reagents, the manufacturing overhead, and so on.

These estimates actually ended up being quite favorable to Cepheid, suggesting that the company was earning a very reasonable 30-40% gross margin on the cartridge at the $10 price. Although MSF didn’t point this out (for obvious reasons), the implication is that after accounting for all costs, Cepheid is probably not making a modest amount of money on the sales of the Xpert MTB/RIF Ultra test cartridge.

Yet, these estimates and a “fair price-reasonable profit” narrative could very well have come from Cepheid/Danahar if the company had simply provided the details of these costs themselves. The company could have gone a step further and given people a context for the $10 price by highlighting the most expensive components and the challenges associated with scaling manufacturing and distribution up or down.

With greater transparency and savvier positioning, they could have shifted MSF’s and John Green’s stilted narrative about price gouging and “letting people die” to a more reasonable discussion about how the company could do even more good than it is doing at present. The $10 price would never have become a PR nightmare. My point is that in some situations, like the one Cepheid found itself in, it pays to be more transparent about prices and their inputs than the company has even been or dared to be.

Standard Markup Frameworks Are Too Simple to Be Effective.

As an outsider not privy to Cepheid’s pricing strategy but as someone who’s seen how pricing strategy works in other similar B2B companies, the $10 price does not seem to include an unreasonable markup to me. However, it does seem to be a standard markup, which could be a significant part of the problem here.

Many B2B companies selling hardware and consumables that I know tend to use a standard markup approach to pricing. What I mean is that when the time comes to raise prices, they raise prices on all their products and services by the same percentage. For example, if the executive leadership decides that 7% is a reasonable revenue growth objective, the managers will be tasked with raising prices by that much on every product and service in the portfolio (assuming a mature market). At most, they may use two or three price increase rates, for instance, raising product prices by 4% and services prices by 9% to get at the 7% overall target. The concept that one should sell an item below cost and lose money on it deliberately to earn a higher profit on the entire sale or to build up goodwill in the community is something that grocery retailers use every day. But it is alien to most B2B companies. It’s also telling that the $10 price hasn’t changed since at least 2011.

Standard markup pricing, while easy to implement and communicate internally, is too simplistic to address the nuances embedded in the MSF accusation. A more complex price structure is required that accounts for differences in various relevant factors such as the functional utility of their products (the life-and-death implication of TB testing), buyers (lower-income country vs. higher-income country), payers (government, patient, foundation, or non-profit), and economic conditions (the impact of inflation on lower-income customers). Prices need to be variable and differentiated, change frequently, and different margins should be targeted and applied to different products in the overall portfolio. For instance, it may make sense to lower the margin target on the Xpert MTB/RIF Ultra test and make it up in other tests that are sold predominantly to higher-income countries or even charge different prices across different markets.

Danaher’s Decisive Move

Less than a week after MSF launched a full-throated campaign, and the Green video went viral, the Global Fund, one of the largest global funders of tuberculosis care, announced that Danaher had agreed to provide:

“Cepheid’s Xpert MTB/RIF Ultra diagnostic test cartridges for tuberculosis (TB) at the price of US$7.97, a 20% reduction from the current price of US$9.98. Danaher has committed to providing these test cartridges at its own cost and states that it will earn no profit from these sales. The agreement between Global Fund and Cepheid also covers improved service and maintenance arrangements and is expected to expand access to millions more high-quality TB tests for people living in low- and middle-income countries where the demand is most pressing.

All the involved parties claimed victory with varying degrees of enthusiasm. MSF put out a press release calling it “an important step in the right direction” but noting that:

“the corporations are not reducing the price of the Xpert MTB/XDR test that is used to diagnose the most severe form of TB, which will remain exorbitant at $14.90, nor are the tests for other diseases included in this reduction. MSF calls on Cepheid and Danaher to work towards further price reductions of the other cartridges, so that more people can access tests that can save their lives.”

MSF also called upon Cepheid/Danaher “to be fully transparent and make the production cost of GeneXpert tests public” and “to make further price reductions for the test to detect XDR-TB (MTB/XDR) and the tests for other diseases to make a meaningful difference for the lives of more people in low- and middle-income countries.” Nerdfighteria’s John Green was similarly delighted, crediting members of his community for turning up the heat on Danaher.

Danaher, for its part, emphasized the $7.97 price in its press release, noting that “By reducing the price of Cepheid's Xpert MTB/RIF Ultra test cartridge to $7.97, Danaher will be selling at its cost and will earn no profit.”

Who won? I am not sure. However, I think, for now, at least, this story has a mostly happy ending. In the end, looking past the posturing and the credit-taking and the self-congratulating, the biggest winners may be the millions of people in lower-income countries with multi-drug-resistant TB. More of them will be diagnosed quickly and treated successfully, and suffering will be reduced. And the battle will go on.

PCR stands for polymerase chain reaction. It is currently the state-of-the-art technology for molecular testing. A PCR test works by finding the DNA or RNA of a pathogen such as a virus in the sample.

Sasikumar, C., Utpat, K., Desai, U., & Joshi, J. (2020). Role of GeneXpert in the diagnosis of mycobacterium tuberculosis. Advances in Respiratory Medicine, 88(3), 183-188.

Sorsa, A., & Kaso, M. (2021). Diagnostic performance of GeneXpert in tuberculosis–HIV co–infected patients at Asella Teaching and Referral Hospital, Southeastern Ethiopia: A cross sectional study. Plos One, 16(1), e0242205.

It is beyond the scope of this post to discuss the science behind PCR tests or the technical details behind the GeneXpert platform. We will take it for granted that this approach is currently state-of-the-art in TB testing and diagnosis.

Williams, V., Calnan, M., Edem, B., Onwuchekwa, C., Okoro, C., Candari, C., Cruz, R. and Otwombe, K., (2022). GeneXpert rollout in three high-burden tuberculosis countries in Africa: A review of pulmonary tuberculosis diagnosis and outcomes from 2001 to 2019. African Journal of Laboratory Medicine, 11(1), 1-8.