Pricing Concept: The SALVE Framework of Price Image

Customer perceptions of the brand's pricing strategy have a significant impact on its value. The SALVE framework is a practical and actionable way to analyze a brand's price image.

“Our feelings are our most genuine paths to knowledge.” - Audre Lorde.

The most valuable global brands are worth over a hundred billion dollars apiece, and dozens of brands are valued in the tens of millions of dollars. A significant portion of this value is derived from how customers feel about the brand’s visible and known pricing activities, or what we will refer to as the brand’s price image.

In this post, I want to define the concept of price image and explain why managers, particularly those involved with pricing strategy, should pay attention to their brand’s price image and build it intentionally. I also want to introduce you to the SALVE Framework of Price Image and briefly discuss how you might use it.

I will define a brand’s price image as “the customer’s perceptions of the brand’s prices, price levels, pricing strategy, price actions, and pricing-related communications combined into an overall descriptive evaluation.” Here are some examples: HEBhas reasonable prices and offers good deals. Netflix has high prices and raises them frequently. You should only buy from Bed Bath & Beyond by using its “20% off any one item” coupon, and so on.

These overall evaluations about the brand’s pricing strategy are valenced, i.e., they are positive or negative. They dictate customer behavior, i.e., whether customers turn to the brand when the occasion arises. The price image also affects customers’ interpretations of specific pricing actions undertaken by the brand and how they react to, for example, price increases. When a brand is intentional in how it uses and communicates pricing cues, its price image contributes positively to its brand value, even a significant chunk.

Price Image Case Study: Walmart vs. Target

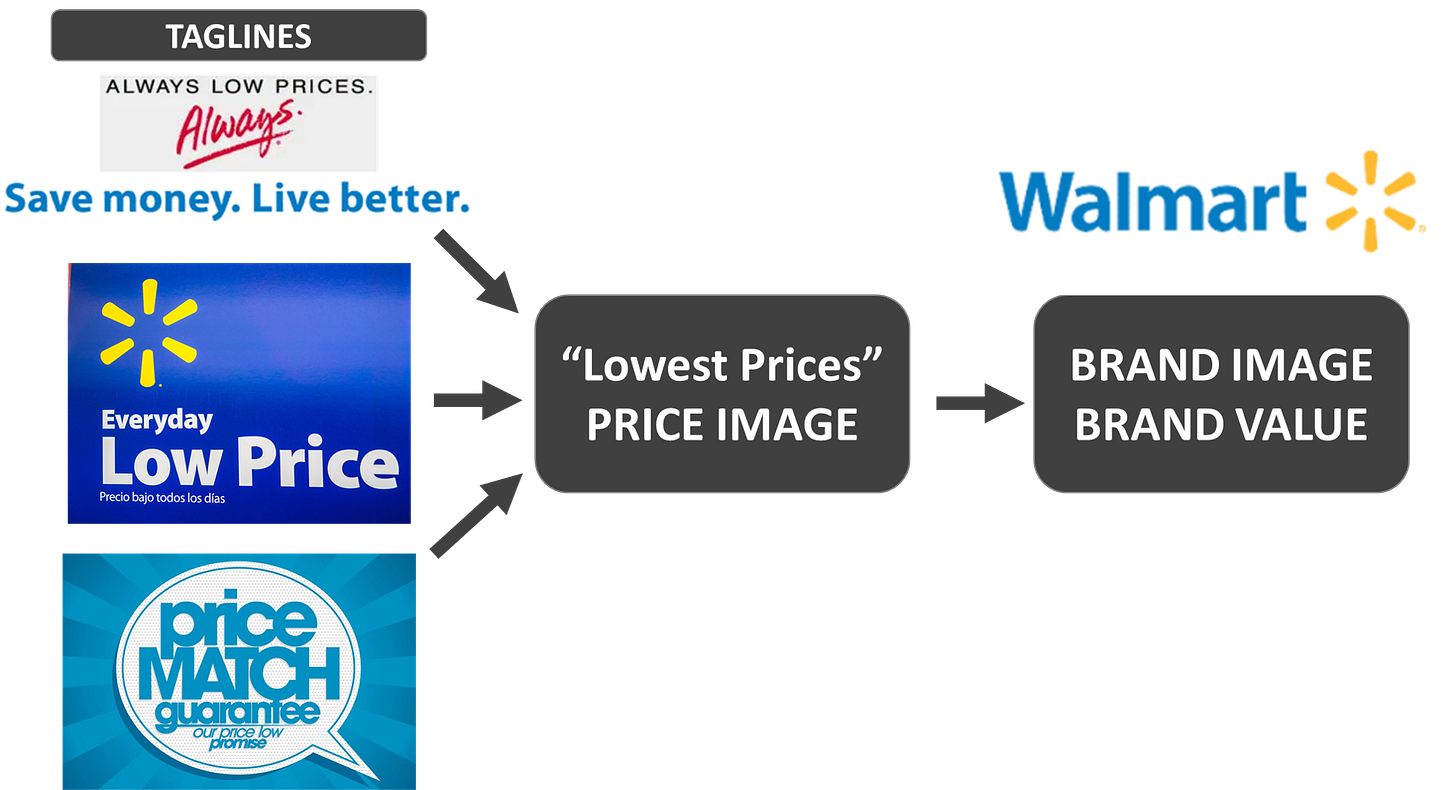

Consider Walmart. It has built its brand around the “lowest prices” price image for decades. Its “Always Low Prices. Always.” tagline lasted for nineteen years, from 1994 to 2007, and was followed by “Save Money. Live Better” from 2007 onwards.

With its current tagline, advertising expert Will Burns has suggested that Walmart is telling its customers that, “We may be big and bad, but we're big and bad on your behalf, consumers, and in the form of lower prices. Lower prices means you can afford more, which means you will live better.”

In other words, a rather nuanced brand association is contained in the rather simple price cue given by the tagline.

The other core elements of Walmart’s pricing strategy such as its widely-publicized decades-long use of everyday low prices and its aggressive price-matching guarantees further reinforce the brand promise of low prices. Because of the coherent messaging and pricing strategy, Walmart’s “has the lowest prices” price image has placed the company as the low-cost leader, contributing significantly to its brand value of $77.5 billion in 2020.

Its direct competitor, Target, uses a very different approach to building its price image. It also made price an important part of its value proposition by capturing its brand’s promise in the tagline “Expect More. Pay Less” and more recently in “What we value most, shouldn’t cost more.”

However, its focus is on providing superior value throughout the customer’s shopping experience, not necessarily in offering the lowest prices for every product it sells. The chief marketing officer of Target explained the logic behind the company’s strategy this way:

“We strive for a balance between making our guests aware of value while emphasizing superior merchandise and a pleasant shopping experience.”

To achieve this balance, Target combines its “superior value” price image with other consistent themes such as “enjoyable and exciting shopping experience,” “friendly service,” “fast checkout” and “beautifully designed and innovative products” to create a more upscale brand image.

One can argue that Target’s price image is more compelling than Walmart’s image to its loyal customers because it is more differentiated. They don’t mind spending more to buy trendier merchandise in a more welcoming ambiance. Nevertheless, Walmart’s price image (obviously) also does the job.

The SALVE Framework of Price Image

Like Walmart and Target show, building a price image is a lot like building a brand. It’s a lengthy, multi-pronged, and challenging undertaking, fraught with uncertainty. A brand’s price image is built from five types of customer perceptions about its pricing strategy: (1) Stability of prices, (2) Accessibility of prices, (3) the price Level, (4) Value for money, and (5) Evaluability of prices1. I call this the SALVE Framework of Price Image. Let’s consider each one.

The SALVE Framework of Price Image

1) Stability of Prices

Price stability reflects the degree to which the company’s prices are perceived as stable vs. changing frequently. Technologies like price optimization software and cloud computing allow companies to change prices quickly and at low cost, even minute-by-minute in real-time if they wish to do so. It is not unusual for prices to change on sites like Amazon and Orbitz several times a day.

On the one hand, frequent changes match prices instantaneously to the inputs that drive customer demand. For instance, if a tollway is exceptionally crowded, it makes sense to increase toll charges immediately to reduce congestion. Or when far too many ride-share users want service in a particular area, surge pricing may be useful to manage demand and increase rider supply.

However, changing the prices of sweaters or laptop computers eight times or more a day makes less sense. Frequently fluctuating prices without an underlying rationale make the shopping decision difficult, and shift customer’s attention away from non-price attributes, hurting brand perceptions.

2) Accessibility of Prices

Price accessibility has to do with the literal availability of the brand’s prices to potential customers. It is the degree to which customers and prospective customers perceive that the brand provides its prices readily. Many brands, especially in the B2B space, make it difficult for potential customers to find prices when they are exploring, browsing, or searching in their decision journeys. They have to contact a salesperson or otherwise put effort to find out the pricing.

In many B2B industries, companies regard prices as proprietary information or trade secrets. B2B consulting firms, for example, describe their services, credentials, and client testimonials in painful detail on their websites, at tradeshows, and in brochures and other marketing collateral, then ask interested customers to call them for obtaining even ballpark pricing. In legal services, it is common to charge clients by the hour. Without a clear explanation of how much time a particular task will take, prices appear inaccessible to many clients.

In consumer settings, one retailer may use small price tags that are hard to read, whereas another may use prominent price tags with large fonts throughout the store or website. Research shows that making prices inaccessible hurts low-cost brands but is beneficial for higher-priced premium brands because it provides customers with exposure to other product attributes first.

Inaccessible and opaque prices shield the brand’s pricing policies from competitors and dampen the incidence of price wars, especially in the B2B space. But on the negative side, hiding prices dissuades some potential buyers and they may go elsewhere, to competitors who have more accessible prices.

3) Level of Prices

The price level is the degree to which the brand’s offerings are consistently perceived as being either higher or lower than its competitors’ comparable offerings. (See this The Pricing Conundrum article for a more detailed discussion about the price level.) A brand that regularly prices its products below competition establishes a low-price image, and one that is usually higher gets pegged as the premium brand, regardless of actual prices, price differences, or profit margins. Customer perception trumps reality.

For example, investment company Vanguard was the first to introduce low-cost mutual funds and index funds to individual investors and charged substantially lower management fees than similar products sold by competitors such as Fidelity, e*Trade, and Charles Schwab. Even years after its competitors caught up and lowered their fees, to levels below Vanguard’s fees in some cases, Vanguard still retains the low-cost price image.

Like Walmart, the low-cost price image is an integral part of Vanguard’s differentiation and fuels its appeal to millions of individual investors. Combined with high-quality service and a famous founder with a mythic origin story (the late John Bogle), the low-cost price image delivers a compelling value proposition.

On the other end of the spectrum, consider the fashion brand Supreme. Its products retail at two to three times its competitors’ prices, which creates a premium, limited-supply image for its merchandise. The same is true of many national brands in fast-moving consumer packaged goods categories. By carefully cultivating a premium image, Proctor & Gamble’s Tide detergent is able to charge price premiums of 25% or more for its Tide Plus line when compared to store brands.

For the price level to affect the company’s price image, it needs to be consistent in its relative price differentials relative to its prominent competitors over a lengthy period. If price levels frequently fluctuate and are sometimes higher and sometimes lower than competitors, as is the case for the US-based full-service airlines such as United, Delta, and American Airlines, it is difficult for consumers to distinguish between the sellers, or to attribute a premium or low price image to a particular company. This is one reason why, even after decades of market dominance, it is hard for American flyers to form coherent price images for the major full-service airlines.

4) Value For Money

Value for money (VFM) is the degree to which customers consistently perceive the brand as providing excellent value at its price level. Both Costco, with its $1.50 hotdog and soda combo, and $4.99 rotisserie chickens, and electric car manufacturer Tesla with its top-of-the-line $80,000 Model S sedan qualify as high VFM brands, because customers perceive each of them as providing excellent value.

When a company earns the VFM badge from customers as opposed to claiming it through advertising or PR, VFM acts as a potent differentiator because it appeals to a wide swathe of customers. Combine the VFM price image with a differentiated offering like that of Aldi, Costco, or Tesla, and the result is rapid growth or high profitability (and in rare cases, both).

However, there is one potential downside to VFM. When it becomes the brand’s centerpiece and is based on an economy or budget positioning, the brand can’t sustain healthy profit margins or raise prices easily. The Indian confectionery manufacturer Parle Products built its brand around a VFM positioning by selling a pack of its flagship Parle-G biscuits for four Indian Rupees for decades. Because of its customers’ strong affinity for the 4 INR price point, the company found it very difficult to raise prices even when its input costs went up considerably during the 2000s. The result was significant margin erosion without any obvious solution. See the video below for a nice discussion of Parle-G’s pricing strategy (it’s in Hindi, though).

5) Evaluability of Prices

Price evaluability is the degree to which the company makes it easy for the customer to process and use prices in their buying decisions. For many customers, prices are inherently difficult to evaluate. The brand can choose how easy or difficult to make the evaluation of its prices.

On the easy side of the spectrum, online retailer Zappos displays prices clearly, includes shipping and returns, and allows the customer to compare prices of different options easily. Its all-inclusive price is easy for consumers to evaluate. On the difficult side, Verizon breaks down and presents the prices of each service separately, making it hard to assess and compare prices. When prices are shown as an itemized list, or on a per-serving or per-ounce basis, consumers have to expend extra effort to figure out the “real” price.

The more evaluable a seller’s prices are, the greater will be the customer’s belief that the seller is transparent about its prices and pricing strategy. This perception, in turn, contributes positively to brand value. Prices that are difficult to evaluate, in contrast, bolster brands that sell sophisticated, complex, or cutting-edge products.

The Key Takeaway

None of the five building blocks of a brand’s price image in the SALVE framework are absolutes. A higher value of any one of them is not necessarily a good thing, nor is a lower value bad. Returning to Walmart and Target, having a low price level makes sense for Walmart because its humongous business is built around the idea of “Always low prices.” But it is not as crucial for Target because its value proposition is to offer fashionable, differentiated merchandise at reasonable prices even if they are not the lowest ones. (see the figure below)

The SALVE framework can be used for any number of practical purposes like graphically depicting and monitoring the price image of a brand, tracking changes in response to pricing strategy changes, and, as shown below, benchmarking the brand’s price image against specific competitors.

SALVE Comparison of Walmart vs. Target Price Image

The core insight for the pricing manager is that the degree of each SALVE price image building block conveys a particular type of brand image to customers. The manager’s task is to ensure that the five building blocks are aligned with other associations and promises of the brand, and together, they provide a compelling and differentiated value proposition to customers.

The five components of the brand’s price image are adapted from Zielke, Stephan. (2010) "How price image dimensions influence shopping intentions for different store formats." European Journal of Marketing, 44(6), 748-770. Zielke studies the price image of retailers. I have expanded the scope of the price image concept to be applicable to any brand. To account for the broader application, I have modified the names and definitions of some of the five components in Zielke’s list of price-image dimensions, borrowing from Hamilton, Ryan, and Alexander Chernev (2013). "Low prices are just the beginning: Price image in retail management." Journal of Marketing, 77(6), 1-20.